In the third installment of the Courier Mail’s series of boardroom forums, agribusiness sector experts are calling for more risk-taking and the removal of barriers to productivity.

Article: Josh Dutton

Photo: Steve Pohlner

Source: Courier Mail

Queensland farmers are operating in a rapidly changing environment as the traditional ways of doing business adapt to new technologies and new markets.

In the third of six boardroom discussions at the BDO offices in Brisbane, representatives from Queensland Business Monthly, BDO and Queensland University Technology discussed foreign investment in the Queensland’s $10 billion agricultural industry, deregulation of the sugar industry and the balance between productivity and profitability.

Conversations from some of the state’s leading experts in the business of agriculture revealed a need to remove barriers from an ‘us and them’ mentality and for more risks to be taken.

De-regulation of the sugar industry

Last year, there was a huge announcement for Queensland’s cane farmers with confirmation Wilmar, one of Asia’s leading agribusiness groups, would be moving away from its marketing agreement with Queensland Sugar Limited in 2017.

While growers were concerned about a lack of transparency and concern for a loss of rights, Bank of Queensland non-executive independent director Richard Haire says the market needed to be deregulated.

“The sugar industry have held on to a convoluted system of profit distribution between the processors, the millers and the marketers. It’s painful,” Haire says.

“At the end of the day, the growers have choice – if Wilmar underperforms, they have options while if the QSC (Queensland Sugar Corporation) under the old one umbrella marketing system failed them, they were toast.”

QUT Business School senior lecturer Dr Mark McGovern says he sees strengths in the old system within possibilities in the new system.

“Growers will see it as others taking income out of their hands,” McGovern says. “It comes down to who gets the dollars and there’s a very strong perception of threat. I see possibilities in the new system but I’m yet to have them confirmed.”

Challenges facing new crops

Queensland can become more competitive on the global market if it backs the chickpea industry.

QUT Science and Engineering Faculty Professor Sagadevan Mundree says the industry has grown “leaps and bounds” over the past five years.

“It’s grown from an $18 million industry to a $550 million industry. The appetite for these products is insatiable,” he says.

Prof Mundree says iron deficiency in countries such as India and Bangladesh could see Queensland cash in.

“If we could increase the buyer availability – this could provide us with a huge competitive edge,” he says.

But he says along with the drought, other problems are halting its progress. Botrytis, similar to Panama disease which nearly killed off all banana plantations in Central and South America, is causing problems.

“We have local challenges – climatic changes, we can only grow it in certain areas and for the past three years lost 30 per cent of our crop to a pathogen called botrytis,” he says.

Prof Mundree says technological advances could create stress-tolerant plants and allow them to grow in broader areas.

Embracing technology

Chief executives are beginning to embrace technology in the name of productivity.

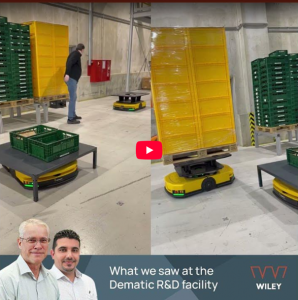

Wiley managing director Tom Wiley says everyone needs to continue to change and organisations need to discuss how they can assist others to innovate.

“I met a few people recently who did a Queensland Government program in design thinking,” Wiley says.

“Most of those businesses have significantly changed and significantly improved.

“They got assistance to innovate to challenge the paradigm and challenge the status quo.”

He says some clients come to him and do not know where to start.

“I think some people see it as an adversity to risk,” Wiley says. “I don’t see it that way at all.”

Wiley says up until recently the biggest barrier to change was CEOs concerned about laying people off and changing labour ratios to match production.

Foreign investment

China’s investment in Queensland’s agriculture industry is growing and it should be seen as a positive for local operators.

BDO partner David Krause says there has been a lot of talk surrounding Chinese investment recently, and although it is at a low level, that is set to change.

“I think we’re starting to see a lot more Chinese investment – particularly in areas like Rockhampton,” he says.

“These investors realise they can’t run places in western Queensland, so it’s the responsibility of the operator to fulfil the interests of both parties.”

BDO managing partner Tony Schiffmann says foreign investment is a great opportunity for local operators.

“They should be coming in with their investment, however, they should also be looking at how they can partner with local operators and do a joint venture,” he says.

Infrastructure issues

A lack of investment in infrastructure has come back to hurt private enterprise.

James Heading Pastoral’s Brett Heading says a recent trip to China opened his eyes to the possibilities of the Government working with producers.

“I visited a facility in Tianjin – they did a joint venture with a French company,” he says.

“It’s quite remarkable – it’s a combination of the Port of Brisbane and the Rocklea markets on steroids. “The Government has a mandate for them to do 20 of them in China.” Heading says the whole purpose of the facility was to strip down the costs of food production and a similar model is needed in Australia.

“The Government hasn’t spent enough on infrastructure,” he says. “It’s been up to private enterprise to do on a small scale what’s needed around Australia.” Heading says businesses have “an enormous amount of lead in their bags. Everything from roads to ports – the Australian Government hasn’t spent enough on them in the last 30 years,” he says.

Industry snapshot

Global economic projection — four per cent growth over next four years

Economic contribution — $10 billion

Number of businesses — 30,500

Land use — approximately 85 per cent of Queensland

Total number of agriculture workers — more than 60,000

Employment — 61% employees, 29% self-employed, 9% employers

Source: Queensland Department of Agriculture and Fisheries